Shared mobility to generate $30 trillion in consumer spending by 2030

FreeRyde will always be free for passengers who know how they are getting to their destination because of our static routes, which allows them to focus on and engage with the media around them.

By 2030, shared mobility could generate up to $1 trillion in consumer spending. New research reveals the trends and data to know.

Shared mobility, or when vehicles are shared among individuals over time or together among multiple passengers, appears to be here to stay. Take, for example, the following:

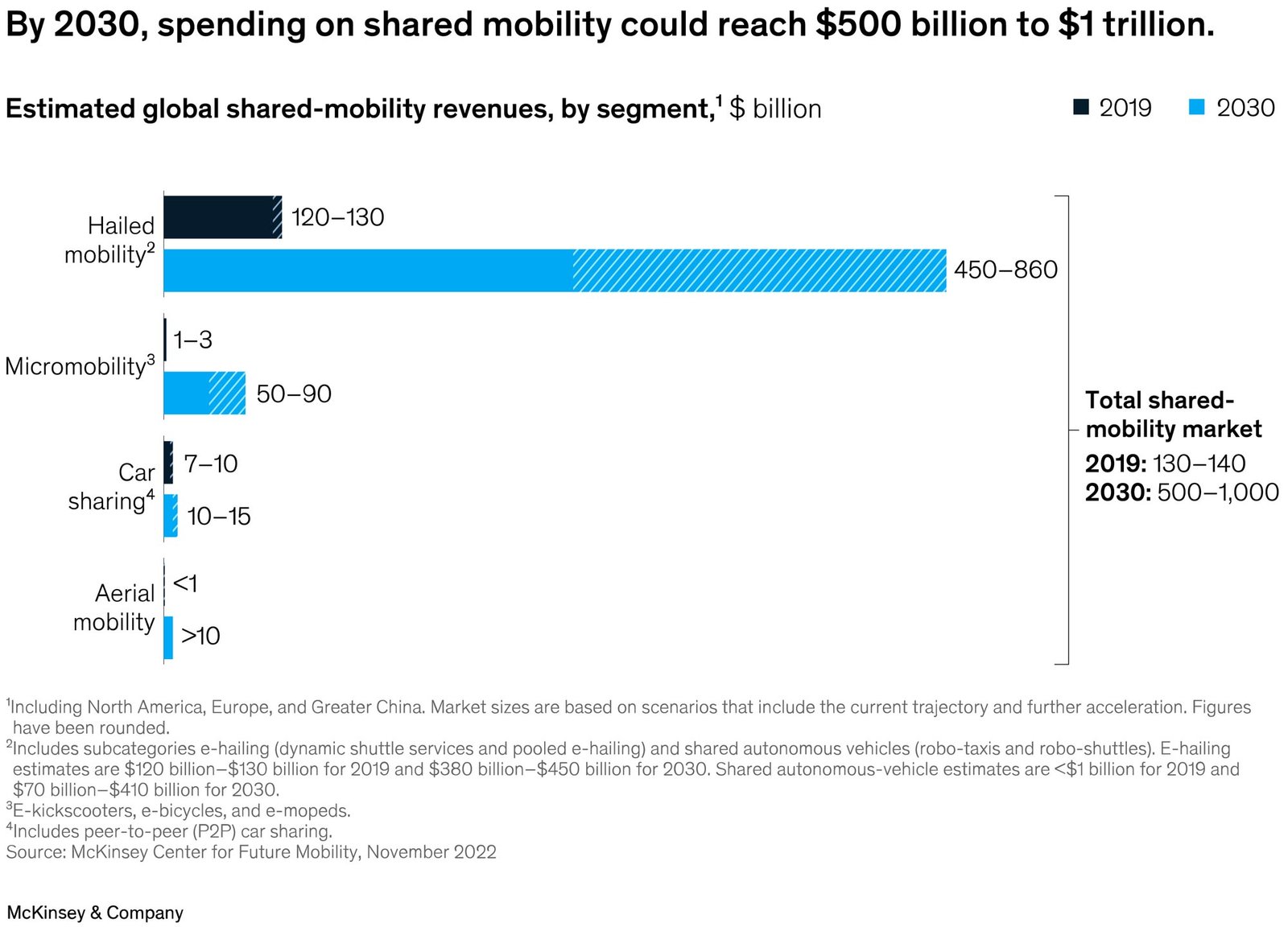

- Consumers racked up more than 15 billion hailed-mobility trips in 2019, with revenues reaching $130 billion. By 2030, total revenues from hailed mobility could increase to between $450 billion and $860 billion, accounting for 80 to 90 percent of consumer spending in shared mobility.

- With a compound annual growth rate (CAGR) of more than 200 percent from 2018 to 2019 in annual yearly trip revenues, the shared-micromobility market is expected to generate up to $90 billion in 2030.

- Fifty-six percent of today’s consumers are willing to replace trips taken in private vehicles with future shared autonomous vehicles. As a result of potentially cannibalizing private-vehicle use and providing a more affordable shared-mobility option than e-hailing today, revenue from robo-taxis and robo-shuttles could reach over $400 billion in 2030, depending on how the related regulations and technologies develop.

As consumers demand convenient, cost-effective, and sustainable modes of travel in urban areas, shared mobility is surging. According to a McKinsey analysis of annual reports, the number of e-hailing trips tripled from 5.5 trillion in 2016 to 16.5 trillion in 2019. Over the past decade, shared mobility has also become an attractive field for investors. Since 2010, private investors, technology companies, and others have directed more than $100 billion into shared-mobility companies. Cities are pursuing emissions-cutting goals to address the climate crisis, and this decade may see an even more dramatic shift to flexible, shared, and sustainable ways to travel. More than 150 cities are currently working to introduce measures aiming to reduce private-vehicle use, McKinsey analysis finds.

In a previous article from August 2021, “Shared mobility: Where it stands, where it’s headed,” we described seven segments of the shared-mobility market, focusing our analysis on the size of the market, investment trends, and consumer sentiment. We found growing consumer demand for shared mobility, with the number of micromobility trips more than doubling within one year. Our consumer research also revealed that for ride-hailing users, the most important features of shared-mobility services are safety, a competitive price, and availability.

In this article, we offer our perspective on four key segments of shared mobility: hailed mobility, car sharing, shared micromobility, and urban aerial mobility (UAM). We also reveal our projections for sizing up the shared-mobility market in 2030, including estimated global revenues and major trends for each segment. Finally, we present two visions of the future of shared mobility based on varying levels of consumer adoption, regulatory support, and technological advancement.

Shared mobility today and in 2030

To highlight the need for shared mobility, look no further than traditional car ownership. Private-passenger cars are convenient but can also be inefficient. For instance, Germany’s passenger-car fleet is around 50 million vehicles, which could potentially provide roughly 250 million seats. With more than 80 million people in Germany, this could theoretically meet the population’s mobility needs. But studies show that private vehicles remain parked about 95 percent of the time and often carry a small number of people. (In Europe, an average of 1.2 to 1.9 people occupy passenger cars traveling in urban areas.) This leads to an average utilization of less than 2 percent of all vehicle seat capacity.

Because of this, city streets and highways are often overflowing with traffic, which further reduces effective use of the mobility system.

We segmented the shared-mobility market based on whether rides are pooled with other passengers or strangers, whether consumers are doing their own driving or are being driven, and types of vehicles shared:

Hailed mobility. This segment includes e-hailing (also called ride-hailing), or the individual or pooled use of both licensed and unlicensed driver services, including dynamic shuttle services. In the future, this category will also include shared autonomous vehicles such as robo-taxis and robo-shuttles.

Shared micromobility. A second segment refers to lightweight vehicles such as electric kickscooters, electric bicycles, and electric mopeds (and potentially other options in the future) that are available for shared public use.

Car sharing. A third segment includes car sharing, or when consumers reserve and use company-provided cars, typically for a limited period of time and in one geographic area. Car sharing may be station based, with vehicles returned to a drop-off point, or free floating, meaning that cars can be picked up and returned anywhere. This segment also includes peer-to-peer (P2P) car sharing. This is when car owners charge other drivers to use their vehicles.

Urban aerial mobility. A fourth segment includes flying electric vehicles that transport consumers by air; these can be piloted or flown (semi) autonomously.

Before the COVID-19 pandemic upended public transportation worldwide, global revenues for shared mobility reached roughly $130 billion to $140 billion in 2019 in the United States, Europe, and Greater China, McKinsey analysis shows. At around $120 billion to $130 billion, the ride-hailing segment received the bulk of consumer spending, with the remaining $10 billion mainly split between car sharing and micromobility.

To help cities, automakers, and mobility players understand how the shared-mobility market could evolve, McKinsey developed a Mobility Market Model that includes data from more than 2,800 cities, clustered into 30 different archetypes. Our model projects passenger kilometers traveled in individual cities for more than ten mobility modes, including public transport, private vehicles, and shared mobility. It can also analyze detailed scenarios to help leaders guide the development of shared mobility. Because McKinsey’s model considers such factors as macroeconomic drivers, cannibalization effects, consumer attitudes, and regulatory effects, it can show how shared mobility may develop within the context of overall mobility.

The shared-mobility market could grow rapidly within the next several years. Depending on customer acceptance of shared mobility, regulations in each country, and the progress of technology, spending on shared-mobility services could reach $500 billion to $1 trillion in 2030, McKinsey analysis finds (Exhibit 1). This would surpass 2019 spending by a magnitude of four to eight and amount to a CAGR of 14 to 19 percent each year from 2019 to 2030.

2 Responses